Essay

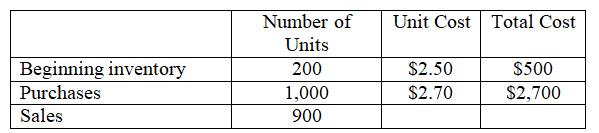

The following information is from the accounting records of JackCo:

Required:

1. Determine the cost of goods sold assuming JackCo uses the first-in, first-out (FIFO) inventory method.

2. Determine the cost of goods sold assuming JackCo uses the last-in, first-out (LIFO) inventory method.

3. Which inventory method results in LOWER taxable income for the period? Why?

Correct Answer:

Verified

1.FIFO: $2,390 = (200 X $2.50)+ (700 X $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q181: Up-a-Creek Company had ending inventory of $60,000,purchases

Q182: Records for the Short Company showed the

Q183: On May 1,Starnes TV had two TV

Q184: On January 5,Boise Cascade Company purchases $5,000

Q185: The cost flow method a firm uses

Q187: Which statement below is TRUE regarding the

Q188: Rigby Company buys merchandise from Shoshone Company

Q189: Sales returns and allowances is a contra-asset

Q190: Souper Bowls sold $500 of merchandise to

Q191: Which statement below best explains the credit