Essay

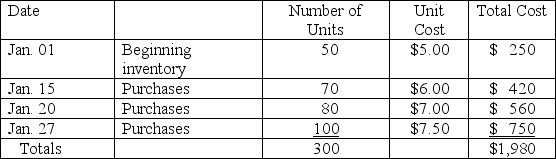

Inventory data for Army & Navy Wear Co.are provided below.Sales for the month were 220 units sold for $12 each.The company maintains a periodic inventory system.

Required:

Required:

1.Determine the cost of goods sold and ending inventory for the month assuming the company uses the FIFO cost flow method.

2.Determine the cost of goods sold and ending inventory for the month assuming the company uses the LIFO cost flow method.

3.Determine the cost of goods sold and ending inventory for the month assuming the company uses the weighted average method.

4.Which method would you recommend that the company use if its objective is to minimize its income tax liability?

Correct Answer:

Verified

1.COGS: $1,380 = (50 x $5)+ (70 x $6)+ (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q175: Which financial statement(s)do you need to calculate

Q176: After a lower-of-cost-or-market write down,Inventory will _.<br>A)increase

Q177: The gross profit ratio is the most

Q178: Mighty Ducks,Inc.'s inventory activity in October 2011

Q179: Philipsburg Corporation sells mugs to fine retailers

Q181: Up-a-Creek Company had ending inventory of $60,000,purchases

Q182: Records for the Short Company showed the

Q183: On May 1,Starnes TV had two TV

Q184: On January 5,Boise Cascade Company purchases $5,000

Q185: The cost flow method a firm uses