Essay

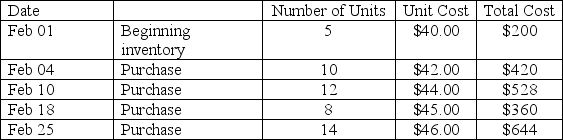

The Quiet Gravestone Company has only one product: a large,3-foot gravestone.Data for inventory during February of the current year are provided below.Assume the company uses a perpetual inventory system and the FIFO cost flow method.

Sales for the month were:

Sales for the month were:

February 7: seven sold at $1,000

February 15: five sold at $1,050

February 20: ten sold at $1,100

Required:

1.What is the cost of goods sold for the February 7 sale?

2.What is the cost of goods sold for the February 15 sale?

3.What is the cost of goods sold for the February 20 sale?

4. If the company used a periodic inventory system and the FIFO cost flow method, what would cost of goods sold be for the month?

Correct Answer:

Verified

1.COGS: $284 = (5 x $40)+ (2 x...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Determine the effect on net income of

Q108: GAAP for inventory costs _.<br>A)allow two cost

Q109: Mighty Ducks,Inc.'s inventory activity in October 2011

Q110: Compare and contrast FIFO,LIFO,and the weighted-average cost

Q111: At December 31,Payless,Inc.reported inventory on the balance

Q113: IFRS do not allow the LIFO cost

Q114: For each of the purchases below made

Q115: If the shipping terms are FOB shipping

Q116: Acme Enterprise sold $150 of merchandise to

Q117: Rigby Company purchased merchandise from a supplier