Essay

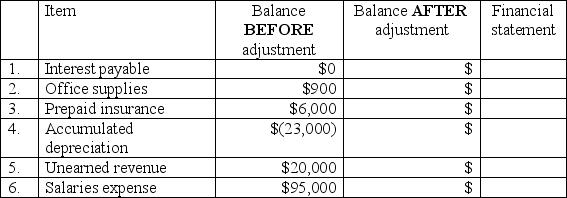

Selected data from RuthCo.'s accounting system are provided below.All balances are BEFORE year-end adjustments and all data relate to the year ended December 31,2011.Determine the amount that will be reported for each of the items in the table below,after the appropriate adjustments have been made using the following information.Also indicate the financial statement where each item appears,using IS for the income statement and BS for the balance sheet.The table does NOT include all accounts that will be adjusted.

a.A $40,000 note payable has been unpaid all year and bears interest at 9%.

b.Equipment that was owned and used all year has a historical cost of $35,000,a 6-year estimated useful life,and a $5,000 estimated residual value.

c.$400 of the supplies were consumed during the year.

d.The prepaid insurance balance relates to a 12-month policy purchased on July 1,2011.

e.$18,000 of the unearned revenue is now earned.

f.Salaries expense does not include $15,000 of employee salaries that have been earned but not yet paid.

Correct Answer:

Verified

Correct Answer:

Verified

Q190: Where should a user of accounting information

Q191: On January 1,2011,Swinger,Inc.purchases a batting machine for

Q192: An increase in a company's profit margin

Q193: Reader,Inc.collected $12,000 in October 2011 from customers

Q194: Rent-a-Wreck,Inc.paid $36,000 cash for a two-year insurance

Q196: Which financial statement shows Cash collected from

Q197: What is book or carrying value?

Q198: An accrual is _.<br>A)a transaction in which

Q199: Use the following code to identify the

Q200: Salaries payable on the balance sheet most