Essay

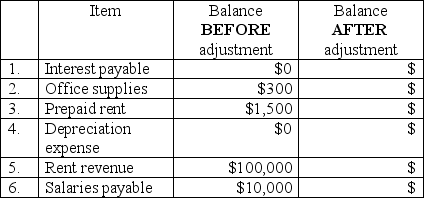

Selected data from BR Co.'s accounting system are provided below.All balances are before year-end adjustments and all data relate to the year ended December 31,2011.Determine the amount that will be reported for each of the items in the table below,after the appropriate adjustments have been made using the following information below.The table does NOT include all of the accounts that will be adjusted.

a.A note payable of $10,000 has been unpaid all year and bears interest at 8%.

b.Equipment with a cost of $20,000,a 5-year estimated useful life,and a $5,000 estimated residual value was owned and used all year.

c.$50 of the supplies are unused at the end of the period.

d.The Prepaid rent balance relates to a $1,500,12-month lease beginning on October 1,2011.

e.$15,000 rent revenue has been earned but not yet collected from tenants.

f.Employees have earned an additional $25,000 in salaries,but have not yet been paid.

Correct Answer:

Verified

_TB5475_00 (a)$10,00...

_TB5475_00 (a)$10,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Enoch,Inc.began operations on July 1,2011.On August 1,it

Q92: Rent a Wreck,Inc.began operations on July 1,2012.On

Q93: Slumbers,Inc.borrows $3,000 at 12% from a bank

Q94: Why would the Unearned revenue account need

Q95: Rent a Wreck,Inc.began operations on July 1,2012.On

Q97: Passwords and user IDs are controls that

Q98: Using the abbreviations below,indicate which financial statement(s)would

Q99: Magic,Inc.collected $12,000 in October 2011 from customers

Q100: Miss Happ of Ace Electronics forgot to

Q101: Which financial statement shows Cash paid to