Essay

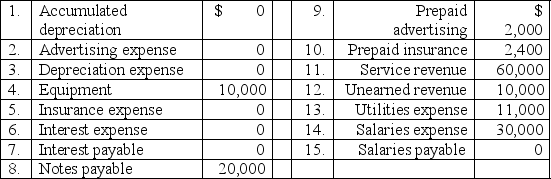

The records of Adam's Apple,Inc.revealed the following amounts at December 31,2011 before adjustments:

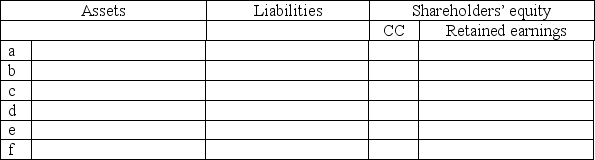

Part A: In the worksheet below,record the effect of these six adjustments on the accounting equation.Show the correct dollar amounts,and write in the titles of the accounts affected.

Part A: In the worksheet below,record the effect of these six adjustments on the accounting equation.Show the correct dollar amounts,and write in the titles of the accounts affected.

a.$400 of the advertising paid in advance remained unused.

b.The equipment,purchased on January 1,has a useful life of 5 years with no residual value.Record the depreciation for the year.

c.Four months of the 12-month insurance policy have NOT expired.

d.Interest is owed on the 6%,9-month note issued on November 1,2011.

e.$6,000 was earned of the amounts collected in advance from customers.

f.$4,000 was owed to employees for work done in December.

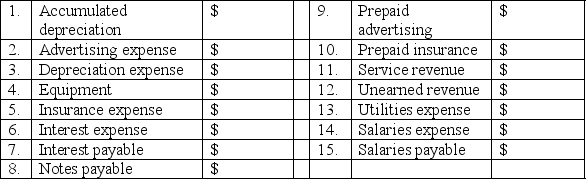

Part B: Fill in the adjusted balances as of December 31,2011:

Part B: Fill in the adjusted balances as of December 31,2011:

Part C: Calculate Adam's Apple's net income for the year ended December 31,2011.$________

Part C: Calculate Adam's Apple's net income for the year ended December 31,2011.$________

Correct Answer:

Verified

Part A

_TB5475_00 Part B:

_TB5475_00 Part B:

_T...

_T...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: On January 1,2011,Beyers Company pays $205,000 cash

Q21: Sam Sleimy wants to borrow money to

Q22: A company's computer system is housed on

Q23: An electronic cash register in a department

Q24: Magic,Inc.collected $24,000 in October 2011 from customers

Q26: Avatar,Inc.bought a machine on January 1,2011 for

Q27: Clean Sweep,Inc.started the month of June with

Q28: Selected data from BabCo.'s accounting system are

Q29: If an adjustment related to employee salaries

Q30: Rent-a-Wreck,Inc.paid $12,000 cash for a one-year insurance