Essay

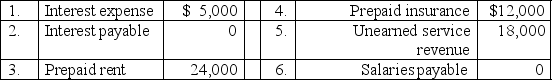

The following is a partial list of items from Stables & Nobles,Inc.'s December 31,2011 financial statements.

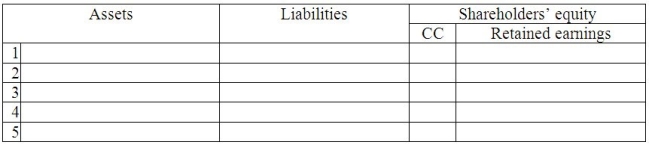

Part A: In the worksheet below,record the effect of these five adjustments on the accounting equation for the year ended December 31,2011.Show the correct dollar amounts,and write in the titles of the accounts affected.

Part A: In the worksheet below,record the effect of these five adjustments on the accounting equation for the year ended December 31,2011.Show the correct dollar amounts,and write in the titles of the accounts affected.

1.There are 3 months left of the 12-month,$12,000 insurance policy that began April 1,2011.

2.Interest of $2,500 is owed and will be paid in January 2012.

3.Two-thirds of the revenue received in advance has been earned as of December 31,2011.

4.Rent paid in advance for twelve months starting August 1,2011 was adjusted.

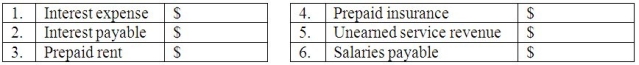

5.Owed $5,000 of salaries for work done in December.The next payday is Jan.3,2012.  Part B: Fill in the adjusted balances as of December 31,2012.Some of the accounts that have been adjusted are not included in this table.

Part B: Fill in the adjusted balances as of December 31,2012.Some of the accounts that have been adjusted are not included in this table.  Part C:

Part C:

Correct Answer:

Verified

Part A:  _TB5475_00 P...

_TB5475_00 P...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q204: An accounting clerk compares a bill received

Q205: A company should never allow copies of

Q206: The bookkeeper of Dew Drop Inn forgets

Q207: The term accounts receivable is used to

Q208: Clean Sweep,Inc.started the month of June with

Q210: Which of the following accounts typically needs

Q211: Sure Enuf,Inc.paid $4,800 on May 1,2012 for

Q212: Mariner,Inc.bought a lobster boat on November 1,2011

Q213: Use the following information from Hormel Foods

Q214: How is net income calculated and on