Essay

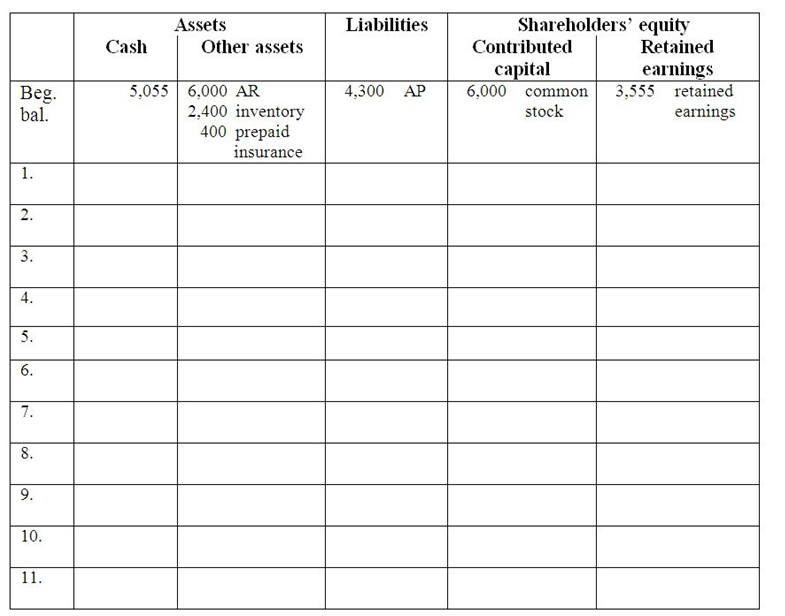

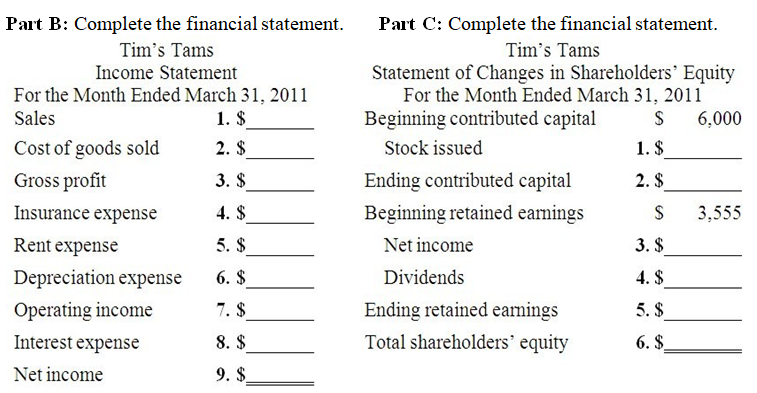

Part A: Enter the March transactions and adjustments in the accounting equation below.

1. March 1 Collected $6,000 of its accounts receivable from February sales.

2. March 1 Tim’s Tams paid $1,000 for two months’ rent beginning March 1.

3. March 1 Borrowed $16,000 on a 4-month, 6% note payable.

4. March 1 Paid $18,000 cash for a truck that has an estimated useful life of 6 years with no salvage value.

5. March 6 Paid $4,300 of its accounts payable from the caps purchased in February.

6. March 20 Tim’s Tams sold 300 baseball caps @ $10.00 each on account. The caps cost $6 each.

7. March 31 Tim’s Tams declared and paid a $500 cash dividend to its shareholder.

8. March 31 Adjusted for insurance used during the month. Recall that on February 1, Tim’s Tams paid $600 for 3 months of insurance coverage that began February 1.

9. March 31 Adjusted for rent used during the month. Recall that Tim’s Tams paid $1,000 for two months’ rent.

10. March 31 Recorded one month’s depreciation on the $18,000 truck that has a 6-year useful life.

11. March 31 Recorded interest on the $16,000, 4-month, 6% note payable for the month.

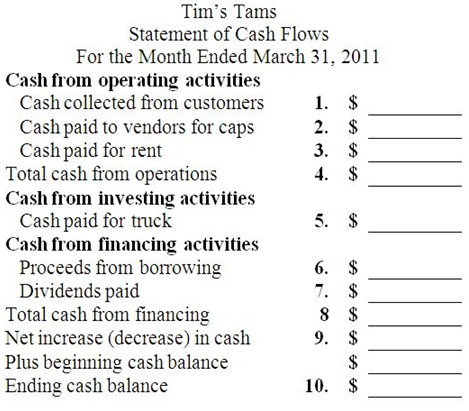

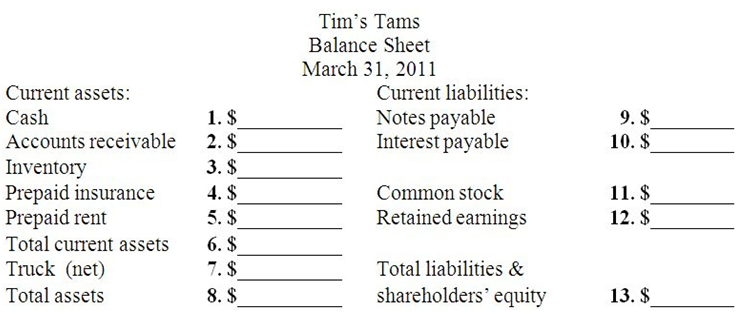

Part D: Complete the financial statement.

Part E:

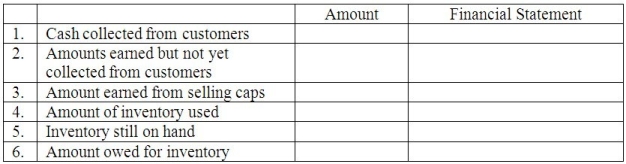

Part F: For each item, write in the amount (even if $0) as of or for the Month ended March 31, 2011 and write in the one financial statement where the line item is found: Part G: Use the transactions and financial statements to answer the following:

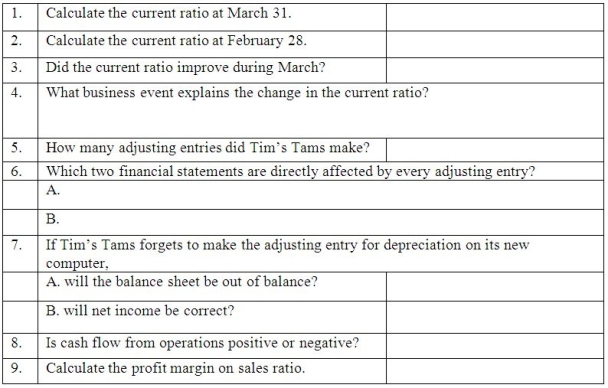

Part G: Use the transactions and financial statements to answer the following:

Correct Answer:

Verified

Part A:  _TB5475_00

_TB5475_00  ...

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q157: Using the following income statement,calculate the profit

Q158: Details,Inc.paints a truck on May 31.The customer

Q159: Identify the effects of each of the

Q160: Clean Sweep,Inc.started the month of June with

Q161: The employees of Dew Drop Inn get

Q163: Use the following code to classify the

Q164: On January 1,2011,We Haul,Inc.bought a $48,000 truck,which

Q165: On June 1,Stackable,Inc.has a balance of $6,000

Q166: _2.Interest income<br>_3.Rent expense<br>_4.Prepaid rent (eight months remaining)<br>_5.Salaries

Q167: The employees of Dew Drop Inn get