Essay

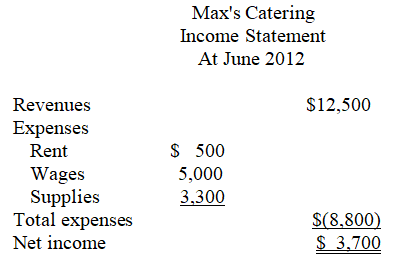

Max is having a problem understanding the financial statements.He believes that his administrative assistant has made some errors in preparing the income statement.Evaluate the following transactions and the income statement prepared by the administrative assistant.Prepare a corrected income statement using U.S.GAAP.

a.Max's Catering earned $10,000 in catering business during June.

b.Customers paid $2,500 in deposits for parties to be catered in July.

c.The business paid $500 for June rent.

d.The business paid the chef $5,000 in wages for June.

e.The business spent $3,300 on food,spices,and other ingredients,and used $1,500 of them during June.

Correct Answer:

Verified

Max's administrative assistant...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: The separate-entity concept means that a company

Q33: What is the purpose of generally accepted

Q34: For June,Team Shirts had a beginning balance

Q35: Match the accounting principle or assumption that

Q36: On January 1,Team Shirts paid $600 for

Q38: Cash-basis accounting is the preferred method of

Q39: On April 25,Team Shirts paid $1,000 for

Q40: The IRS developed GAAP,or generally accepted accounting

Q41: The Financial Accounting Standards Board sets international

Q42: For each of the following situations discuss