Essay

Team Instructions: Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final correct copy of the problem.Each team should turn in only one copy of the problem for grading.All team members will receive the same grade.

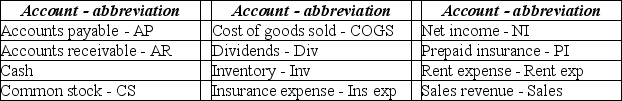

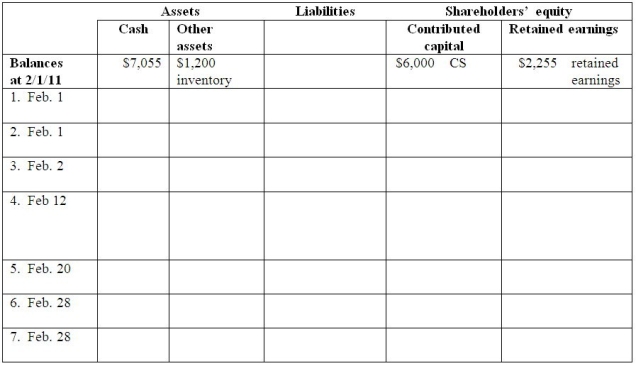

Part A: Record the transactions below by filling in the amount and the account title from the list of accounts below (use the abbreviations given):

1.February 1 Tim's Tams paid $800 for February's rent of a booth.

1.February 1 Tim's Tams paid $800 for February's rent of a booth.

2.February 1 Tim's Tams paid $600 cash for three months of insurance coverage that begins February 1.

3.February 2 Tim's Tams purchased 800 baseball caps that cost $6.00 each on account.

4.February 12 Tim's Tams sold 600 baseball caps @ $10.00 each on account.

Record both a)the sale and b)the cost of the sale.

5.February 20 Tim's Tams paid for $500 of the caps purchased on February 2.

6.February 28 Tim's Tams declared and paid a $100 cash dividend to its shareholder.

7.February 28 Adjusted for insurance used during the month.  Parts B,C,D and E:

Parts B,C,D and E:

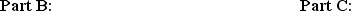

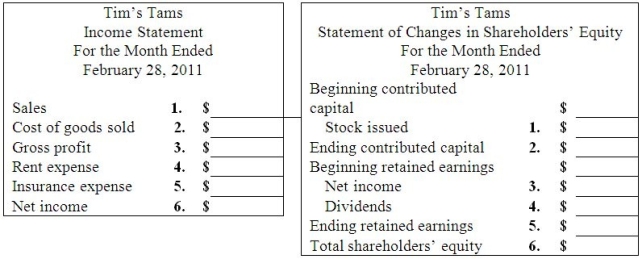

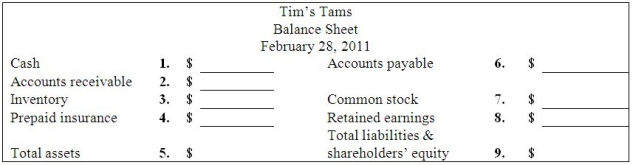

Complete the four financial statements:

Part D:

Part D:  Part E:

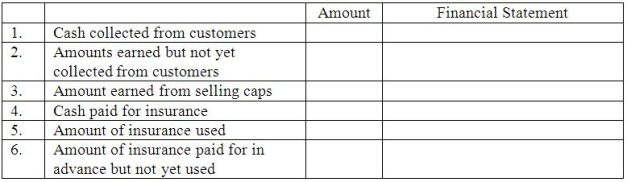

Part E:  Part F: For each description,write in the amount and show on which of the February financial statements this information is found.

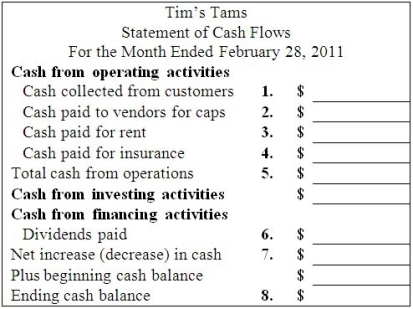

Part F: For each description,write in the amount and show on which of the February financial statements this information is found.  Part G: Using the financial statements above,answer the following:

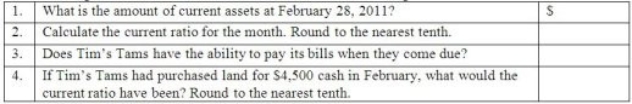

Part G: Using the financial statements above,answer the following:

Correct Answer:

Verified

Part A:  _TB5475_00

_TB5475_00  _TB5475_00 ...

_TB5475_00 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Busy Beaver had revenues of $2,000,cost of

Q108: Clean Sweep performed cleaning services and billed

Q109: The owner of a sole proprietorship should

Q110: Classify each of the items below according

Q111: Indicate with an "X" the one financial

Q113: Explain the differences between cash-basis and accrual

Q114: Name one type of preventive control that

Q115: Clean Sweep had current assets of $650

Q116: Baby Boutique had $250 worth of supplies

Q117: The going-concern assumption refers to _.<br>A)measuring the