Short Answer

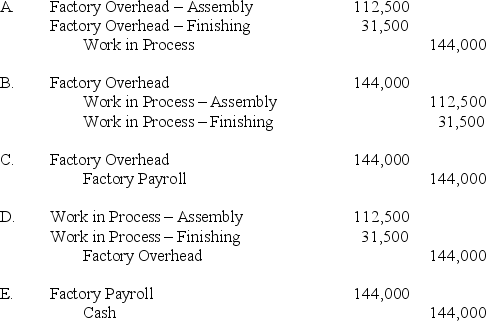

Hou Company applies factory overhead to its production departments on the basis of 90% of direct labor costs.In the Assembly Department, Hou had $125,000 of direct labor cost, and in the Finishing Department, Hou had $35,000 of direct labor cost.The entry to apply overhead to these production departments is:

Correct Answer:

Verified

Correct Answer:

Verified

Q39: The purchase of raw materials on account

Q78: The process cost summary is an important

Q92: If the predetermined overhead allocation rate is

Q94: To compute an equivalent unit of production,one

Q94: If a department that applies process costing

Q97: Process manufacturing, also called process operations or

Q97: If Department T uses $89,000 of direct

Q103: At the beginning of the recent period,there

Q164: Reference: 16_05<br>Refer to the following incomplete table

Q166: A company's beginning work in process inventory