Multiple Choice

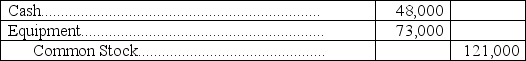

S.Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership.The journal entry to record the transaction for the partnership is:

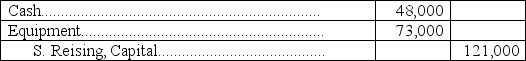

A)

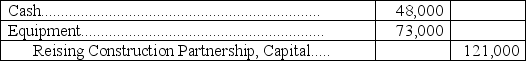

B)

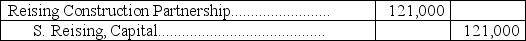

C)

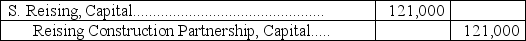

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Tanner,Schmidt,and Hayes are partners with capital account

Q21: Juanita invested $100,000 and Jacque invested $95,000

Q29: A partnership that has two classes of

Q29: If the partners agree on a formula

Q51: Groh and Jackson are partners.Groh's capital balance

Q56: Armstrong plans to leave the FAP Partnership.The

Q57: Miller and Reising formed a partnership.Miller contributed

Q67: The statement of partners' equity shows the

Q115: Which of the following best lists the

Q171: If a partner withdraws from a partnership