Essay

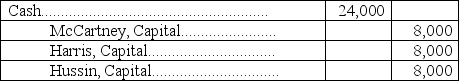

McCartney, Harris, and Hussin are dissolving their partnership.Their partnership agreement allocates each partner 1/3 of all income and losses.The current period's ending capital account balances are McCartney, $13,000; Harris, $13,000; and Hussin, $(2,000).After all assets are sold and liabilities are paid, there is $24,000 in cash to be distributed.Hussin is unable to pay the deficiency.The journal entry to record the distribution should be:

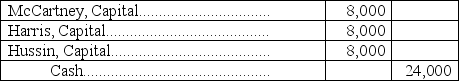

A.

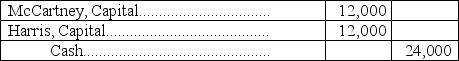

B.

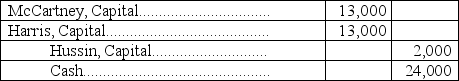

C.

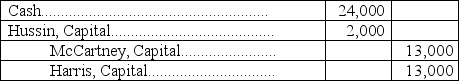

D.

E.

Correct Answer:

Verified

B

_TB6311...

_TB6311...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Collins and Farina are forming a partnership.Collins

Q55: When a partnership is liquidated,which of the

Q60: Identify and discuss the key characteristics of

Q65: Admitting a partner into a partnership by

Q68: Baldwin and Tanner formed a partnership.Baldwin's initial

Q70: If partners devote their time and services

Q73: What are the ways a partner can

Q104: Khalid,Dina,and James are partners with beginning-year capital

Q124: Assume that the S & B partnership

Q131: In the absence of a partnership agreement,