Multiple Choice

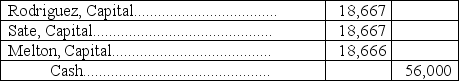

Rodriguez, Sate, and Melton are dissolving their partnership.Their partnership agreement allocates income and losses equally among the partners.The current period's ending capital account balances are Rodriguez, $30,000; Sate, $30,000; and Melton, $(4,000) .After all the assets are sold and liabilities are paid, but before any contributions are considered to cover any deficiencies, there is $56,000 in cash to be distributed.Melton pays $4,000 to cover the deficiency in her account.The general journal entry to record the final distribution would be:

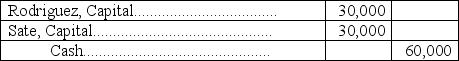

A)

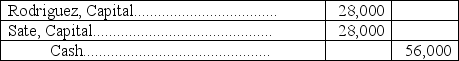

B)

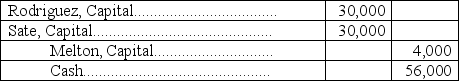

C)

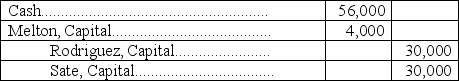

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Partner return on equity can be used

Q25: During 2013,Carpenter invested $75,000 and DiAngelo invested

Q35: Benson is a partner in B&D Company.

Q84: When a partner leaves a partnership, the

Q85: Sierra and Jenson formed a partnership. Sierra

Q89: Conley and Liu allow Lepley to purchase

Q113: A capital deficiency can arise from liquidation

Q125: Rodriguez,Sate,and Melton are dissolving their partnership.Their partnership

Q126: The equity section of the balance sheet

Q133: Web Services is organized as a limited