Essay

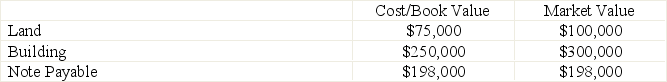

Kathleen Reilly and Ann Wolf decide to form a partnership on August 1.Reilly invested the following assets and liabilities in the new partnership:

The note payable is associated with the building and the partnership will assume the responsibility for the loan.Wolf invested $60,000 in cash and $105,000 in new equipment in the new partnership.Prepare the journal entries to record the two partner's original investments in the new partnership.

The note payable is associated with the building and the partnership will assume the responsibility for the loan.Wolf invested $60,000 in cash and $105,000 in new equipment in the new partnership.Prepare the journal entries to record the two partner's original investments in the new partnership.

Correct Answer:

Verified

_TB6311_00...

_TB6311_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Holden,Phillips,and Rogers are partners with beginning-year capital

Q31: To buy into an existing partnership,the new

Q46: Partners' withdrawals of assets are:<br>A) Credited to

Q54: Accounting procedures for all items are the

Q59: In closing the accounts at the end

Q77: An unincorporated association of two or more

Q82: Marquis and Bose agree to accept Sherman

Q113: The BlueFin Partnership agrees to dissolve. The

Q157: During the closing process, each partner's withdrawals

Q170: Discuss the options for the allocation of