Essay

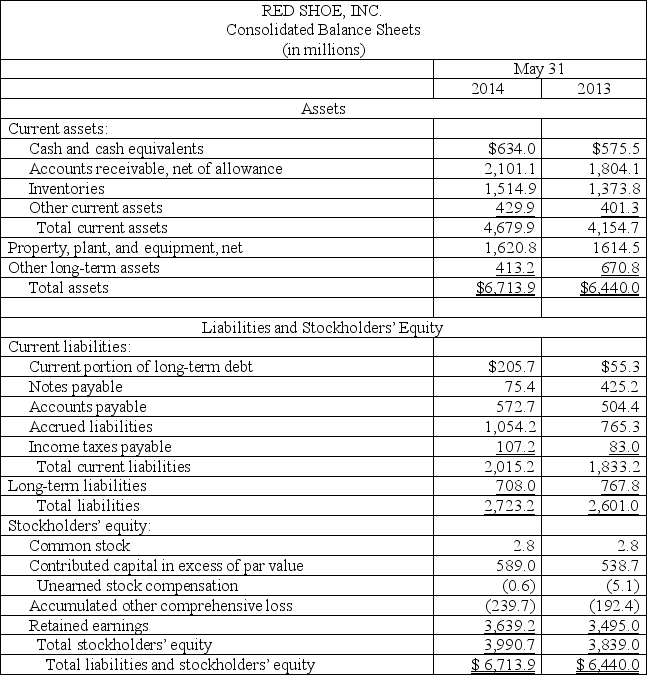

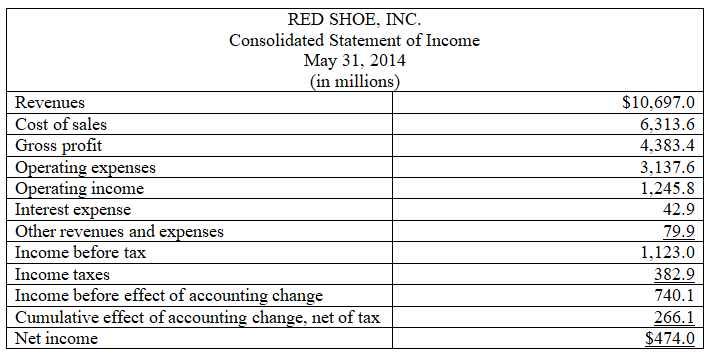

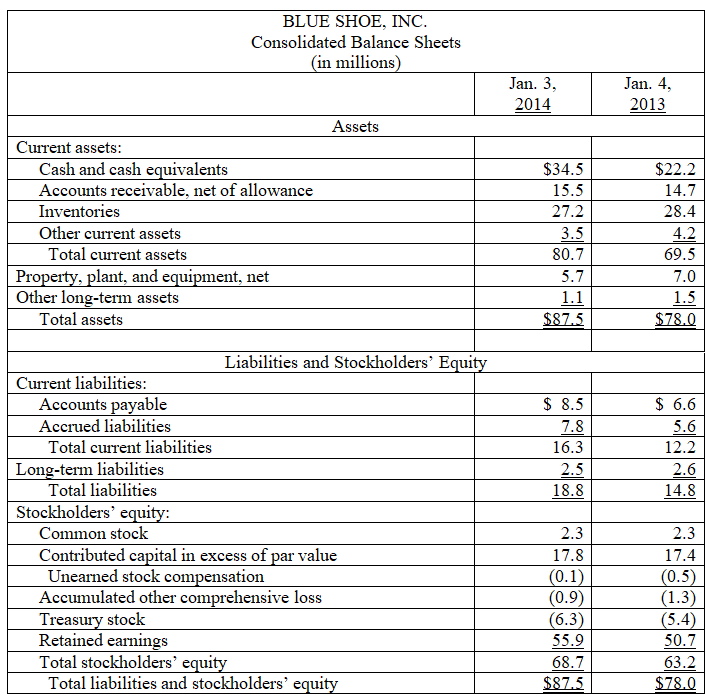

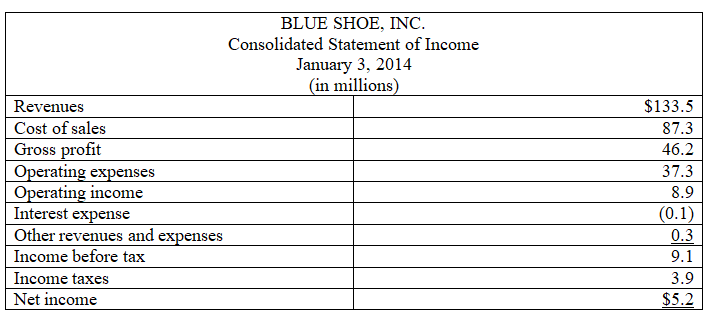

The following are summaries from the income statements and balance sheets of Red Shoe,Inc.and Blue Shoe,Inc.

(1) For both companies compute the following ratios for 2014:

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies compute the following ratios for 2014:

(a) Profit margin ratio

(b) Return on total assets

(c) Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Correct Answer:

Verified

Comment:

Blue Shoe has higher current r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Comment:

Blue Shoe has higher current r...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Total asset turnover reflects a company's ability

Q108: Profitability is the ability to generate positive

Q145: Corona Company's balance sheet accounts follow: <img

Q148: Liquidity and efficiency are measures of a

Q149: Which of the following items is not

Q151: Intracompany standards for financial statement analysis are:<br>A)Often

Q152: The higher the accounts receivable turnover,the slower

Q153: A corporation reports the following year-end balance

Q155: For the following financial statement items,calculate trend

Q218: Identify and explain the four building blocks