Multiple Choice

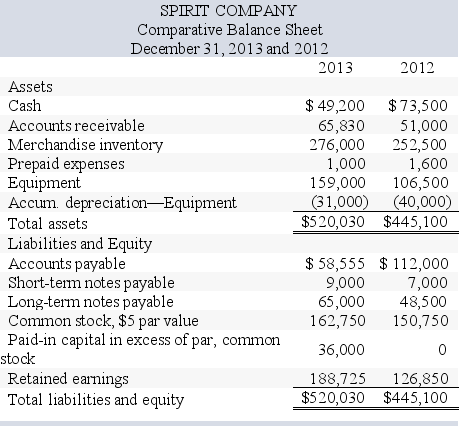

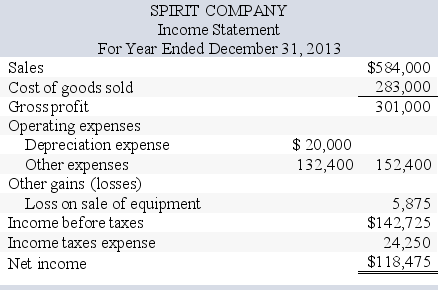

Spirit Company,a merchandiser,recently completed the 2013 calendar year.For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory,and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses.The company's balance sheet and income statement follow:

Additional information on year 2013 transactions:

Additional information on year 2013 transactions:

Additional information on year 2013 transactions:

a.The loss on the cash sale of equipment was $5,875 (details in b) .

b.Sold equipment costing $46,500, for a loss of $5,875.

c.Purchased equipment costing $99,000 by paying $35,000 cash and signing a long-term note payable for the balance.

d.Borrowed $2,000 cash by signing a non-sales related short-term note payable.

e.Paid $47,500 cash to reduce the long-term notes payable.

f.Issued 2,400 shares of common stock for $20 cash per share.

g.Net income and dividends were the only items that affected retained earnings.

-Required: What is the amount of dividends declared and distributed in 2013?

A) $180,350

B) $8,375

C) $61,875

D) $56,600

E) $70,250

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Explain the value of separating cash flows

Q25: Wessen Company reports net income of $180,000

Q27: For each of the following items,indicate whether

Q28: Based on the information provided below,complete the

Q29: Based on the following income statement and

Q31: The statement of cash flows explains how

Q79: When analyzing the changes on a spreadsheet

Q127: A machine with a cost of $130,000

Q181: The FASB recommends that the operating section

Q225: Define the cash flow on total assets