Multiple Choice

A corporation had 20,000 shares of $10 par value common stock outstanding on January 10.Later that day the board of directors declared a 30% stock dividend when the market value of each share was $40.The entry to record this dividend is:

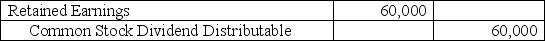

A)

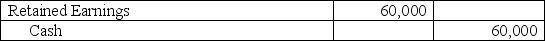

B)

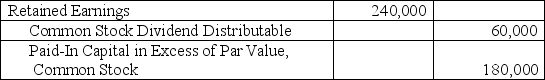

C)

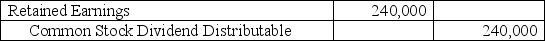

D)

E) No entry is made until the stock is issued

Correct Answer:

Verified

Correct Answer:

Verified

Q19: A company has 1,000 shares of $50

Q176: Reynaldo Inc.issued 1,000 shares of $10 stated

Q177: On January 1,2014,Elliott Corp.repurchased 1,000 shares of

Q178: The journal entry to record distribution of

Q182: Xtreme Sports has $100,000 par,8% noncumulative,nonparticipating,preferred stock

Q183: A company has 2,000 shares of $1

Q184: The stockholders' equity section of a corporation's

Q185: Preferred stock on which the right to

Q186: A company sold stock for $733,000.The shares

Q212: What are the rights generally granted to