Multiple Choice

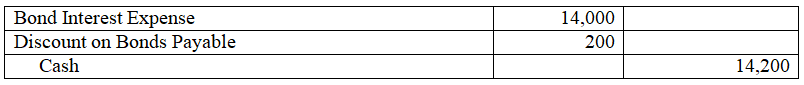

On January 1,2013,a company issued and sold a $400,000,7%,10-year bond payable and received proceeds of $396,000.Interest is payable each June 30 and December 31.The company uses the straight-line method to amortize the discount.The journal entry to record the first interest payment is:

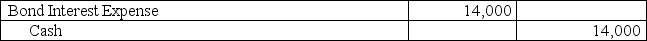

A)

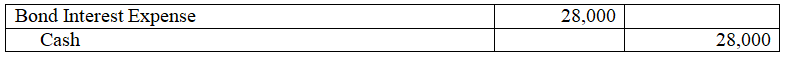

B)

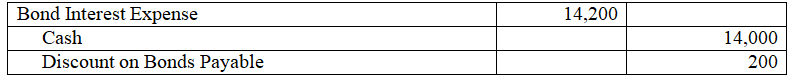

C)

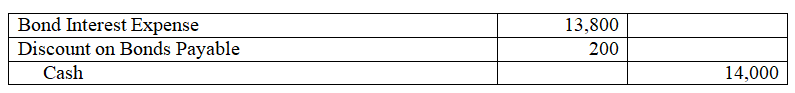

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q48: _ bonds have an option exercisable by

Q66: The _ amortization method allocates bond interest

Q70: On January 1,2013,Lane issues $700,000 of 7%,15-year

Q72: The interest rate specified in the bond

Q74: The Premium on Bonds Payable account is

Q76: On January 1,2013,$800,000,5-year,bonds with a contract rate

Q99: If a bond's interest period does not

Q105: Bonds and long-term notes are similar in

Q141: On March 1,a company issues bonds with

Q224: _leases are short-term or cancelable leases in