Multiple Choice

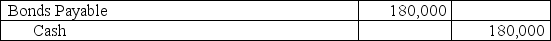

On January 1,2013,Jacob issued $600,000 of 11%,15-year bonds at a price of 102½.The straight-line method is used to amortize any bond discount or premium and interest is paid semiannually.All interest has been accounted for (and paid) through December 31,2018.The company retires 30% of these bonds by buying them on the open market at 98½. What is the journal entry to record the retirement of 30% of the bonds on January 1,2019?

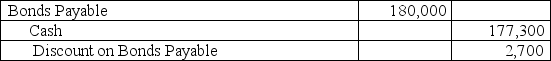

A)

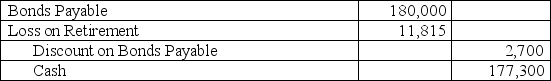

B)

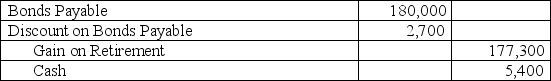

C)

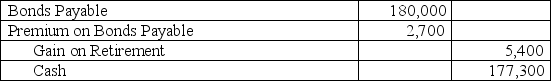

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q76: A _ is a contractual agreement between

Q106: The carrying value of a long-term note

Q114: A corporation borrowed $125,000 cash by signing

Q116: A common payment pattern for installment notes

Q117: A company borrowed $300,000 cash from the

Q118: A company has $200,000 par value,10% bonds

Q121: A company issued 10%,five-year bonds with a

Q122: On January 1,a company issues bonds with

Q124: Most mortgage contracts grant the lender the

Q149: Explain the accounting procedures when a bond's