Essay

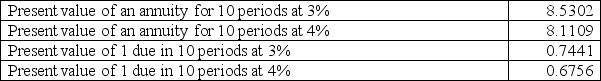

On January 1,a company issues bonds with a par value of $300,000.The bonds mature in five years and pay 8% annual interest each June 30 and December 31.On the issue date,the market rate of interest is 6%.Compute the price of the bonds on their issue date.The following information is taken from present value tables:

Correct Answer:

Verified

_TB6947_00...

_TB6947_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: A bond traded at 102½ means that:<br>A)

Q36: Explain how to record the issuance and

Q37: The type of bond that provides the

Q37: _ bonds reduce a bondholder's risk by

Q40: On January 1,2013,Jacob issued $600,000 of 11%,15-year

Q41: The par value of a bond is

Q43: A bondholder that owns a $1,000,10%,10-year bond

Q46: Define the debt to equity ratio and

Q47: The carrying value of a bond payable

Q68: The _ method of amortizing a bond