Essay

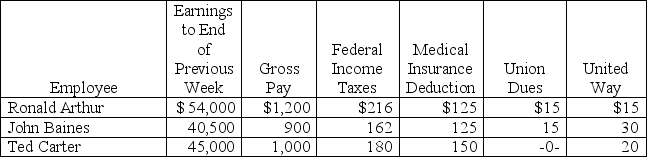

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA Social Security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA Social Security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Correct Answer:

Verified

Salaries and Wages Expense = ($1,200 + $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: An estimated liability is a known obligation

Q142: The matching principle requires that interest expense

Q158: The Form W-2 must be given to

Q159: An employee earned $3,450 wages for the

Q160: On October 10,2013,Printfast Company sells a commercial

Q161: Unearned revenues are amounts received _from_ for

Q164: On November 1,2012,Bob's Skateboards Store signed a

Q165: When the times interest earned ratio declines,the

Q166: A company's income before interest expense and

Q167: An employee earnings report:<br>A)Is the W-2.<br>B)Is the