Essay

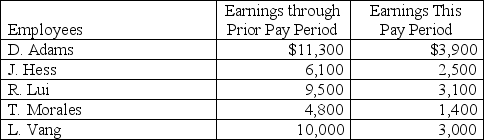

A company's employees had the following earnings records at the close of the current payroll period:

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $110,100 (for 2012) plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $110,100 (for 2012) plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

_TB6947_00_TB6947_00...

_TB6947_00_TB6947_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Companies with many employees often use a

Q72: A table that shows the amount of

Q107: An employer's federal unemployment taxes (FUTA) are

Q114: The difference between the amount received from

Q116: Current liabilities are obligations not due within

Q117: On October 10,2013,Printfast Company sells a commercial

Q122: FUTA is the abbreviation for social security

Q123: Metro Express has five sales employees,each of

Q124: On December 1,2013,Gates Company borrowed $45,000 cash

Q128: Accounting for contingent liabilities covers three possibilities: