Essay

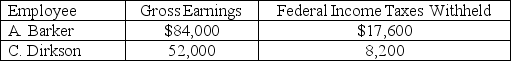

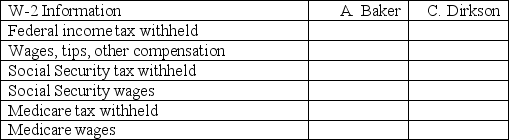

A company's employer payroll taxes are 0.8% for federal unemployment taxes,5.4% for state unemployment taxes,6.2% for FICA Social Security taxes on earnings up to $110,100 (for 2012) and 1.45% for FICA Medicare taxes on all earnings.Compute the W-2 Wage and Tax Statement information required below for the following employees:

Correct Answer:

Verified

Correct Answer:

Verified

Q100: One of the employees of the Hill

Q103: What are known current liabilities? Provide at

Q104: Karen Cooper,the founder of SmartIT Staffing,realized that

Q106: Home Depot had income before interest expense

Q107: A high value for the times interest

Q109: Employers must pay FICA taxes that are

Q110: Walmart had income before interest expense and

Q153: Trade accounts payable are amounts owed to

Q168: The full disclosure principle requires the reporting

Q177: A company sold $12,000 worth of trampolines