Essay

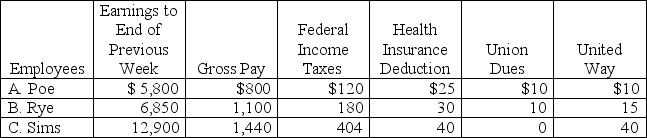

The payroll records of a company provided the following data for the currently weekly pay period ended March 7:

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: The current FUTA tax rate is 0.8%

Q74: If a company paid $820,000 in bonuses,and

Q75: When companies pay the government collected sales

Q77: Which of the following is a true

Q79: Contingent liabilities are recorded if the future

Q80: Mission Company has three employees: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6947/.jpg"

Q82: Times interest earned can be calculated by

Q83: The amount of federal income taxes withheld

Q97: A payroll register is a cumulative record

Q142: A _ is a seller's obligation to