Multiple Choice

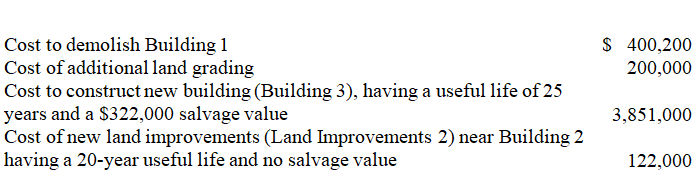

Giant Green Company pays $3,000,000 for a tract of land with two buildings on it.It plans to demolish Building 1 and build a new store in its place.Building 2 will be a company office; it is appraised at $742,000,with a useful life of 25 years and a $75,000 salvage value.A lighted parking lot near Building 1 has improvements (Land Improvements 1) valued at $400,500 that are expected to last another 18 years with no salvage value.Without the buildings and improvements,the tract of land is valued at $2,020,600.Giant Green also incurs the following additional costs:

-What is the amount that should be recorded for the tract of land?

A) $2,516,600

B) $2,020,600

C) $3,851,000

D) $1,916,400

E) $3,000,000

Correct Answer:

Verified

Correct Answer:

Verified

Q57: A company purchased mining property containing 7,350,000

Q59: A company purchased equipment for $50,000 on

Q60: Ace Company purchased a machine valued at

Q61: Endor Fishing Company exchanged an old boat

Q64: A company purchased a leasehold property for

Q66: A company discarded a display case that

Q67: Match each of the following terms with

Q95: A machine originally had an estimated useful

Q191: Depreciation:<br>A)Measures the decline in market value of

Q197: A company had net sales of $541,500