Multiple Choice

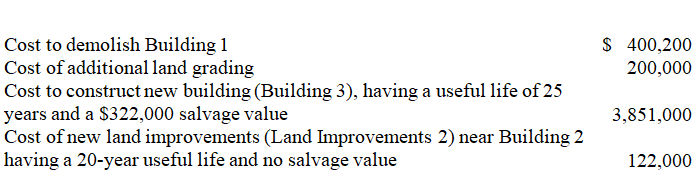

Giant Green Company pays $3,000,000 for a tract of land with two buildings on it.It plans to demolish Building 1 and build a new store in its place.Building 2 will be a company office; it is appraised at $742,000,with a useful life of 25 years and a $75,000 salvage value.A lighted parking lot near Building 1 has improvements (Land Improvements 1) valued at $400,500 that are expected to last another 18 years with no salvage value.Without the buildings and improvements,the tract of land is valued at $2,020,600.Giant Green also incurs the following additional costs:

-What is the amount that should be recorded for Building #2?

A) $600,200

B) $742,000

C) $667,000

D) $703,800

E) $487,921

Correct Answer:

Verified

Correct Answer:

Verified

Q111: Decision makers and other users of financial

Q113: A company had a bulldozer destroyed by

Q114: A company purchased land on which to

Q115: A company purchased property for $100,000.The property

Q116: Both the straight-line depreciation method and the

Q117: A company purchased equipment valued at $200,000

Q121: A company's annual accounting period ends on

Q122: A company made the following expenditures in

Q123: Ace Company purchased a machine valued at

Q207: _ are capital expenditures that make a