Essay

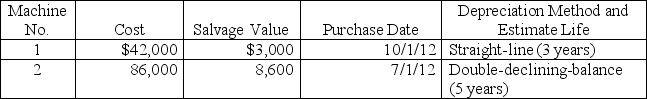

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine for the year ended December 31,2013,and for the year ended December 31,2012.

Calculate the depreciation expense for each machine for the year ended December 31,2013,and for the year ended December 31,2012.

Machine 1:

2012 _______________________

2013 _______________________

Machine 2:

2012 _______________________

2013 _______________________

Correct Answer:

Verified

Machine 1:

2012: [($42,000 - $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2012: [($42,000 - $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Ordinary repairs are expenditures that keep assets

Q69: A company sold a machine that originally

Q108: Goodwill is the amount by which a

Q110: Explain the purpose and method of depreciation

Q111: The going-concern principle supports the reporting of

Q113: A company had a bulldozer destroyed by

Q114: A company purchased land on which to

Q115: A company purchased property for $100,000.The property

Q116: Both the straight-line depreciation method and the

Q117: A company purchased equipment valued at $200,000