Essay

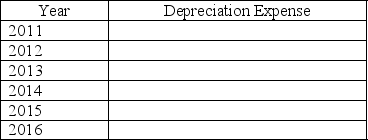

The Weiss Company purchased a truck for $95,000 on January 2,2011.The truck was estimated to have a $3,000 salvage value and a four-year life.The truck was depreciated using the straight-line method.During 2013,it was obvious that the truck's total useful life would be six years rather than four and the salvage at the end of the sixth year would be $1,500.Determine the depreciation expense for the truck for the six years of its life.

Correct Answer:

Verified

2012 - 2013 depreciation = ($9...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Revising an estimate of the useful life

Q38: A copyright gives its owner the exclusive

Q60: Mason Company sold a piece of equipment

Q195: When the value of plant assets decline

Q197: On April 1,2013,a company discarded a computer

Q199: A leasehold:<br>A)Is a short-term rental agreement.<br>B)Is the

Q201: Heidel Co.paid $750,000 cash to buy the

Q202: A depreciable asset currently has a $40,100

Q204: A company had average total assets of

Q235: If an asset is sold above its