Essay

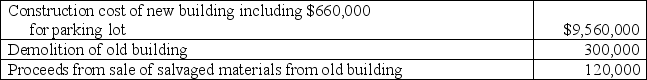

A company needed a new building.It found a suitable location with an existing old building on the land.The company reached an agreement to buy the land and the building for $960,000 cash.The old building was demolished to make way for the needed new building.Following is information regarding the demolition of the old building and construction of the new one:

Prepare a single journal entry to record the above costs assuming all transactions are paid in cash.

Prepare a single journal entry to record the above costs assuming all transactions are paid in cash.

Correct Answer:

Verified

_TB6947_00...

_TB6947_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Once the estimated depreciation expense for an

Q42: _ depreciation uses a depreciation rate that

Q67: Explain the difference between revenue expenditures and

Q185: A company sold equipment for $50,000.Total accumulated

Q186: Clark Street Company purchases $50,000 in new

Q187: The cost principle requires that an asset

Q191: On April 1,2013,a company disposed of equipment

Q193: A company's old machine,which cost $40,000 and

Q194: Most companies use accelerated depreciation for tax

Q217: Define plant assets and identify the four