Multiple Choice

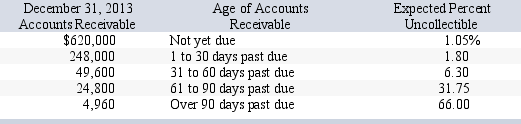

Temper Company has credit sales of $3.10 million for year 2013.Temper estimates that .9% of the credit sales will not be collected.On December 31,2013,the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $2,222.Temper prepares a schedule of its December 31,2013,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:  Assuming the company uses the aging of Accounts Receivable method,what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

Assuming the company uses the aging of Accounts Receivable method,what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

A) $25,246.40

B) $27,468.40

C) $23,024.40

D) $27,900.00

E) $24,420.40

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Twin Cities Consulting uses the allowance method.Prepare

Q4: On November 15,2013,Betty Corporation accepted a note

Q7: Prepare general journal entries for the following

Q9: Acme Company has credit sales of $3.10

Q11: Timmons Company had a January 1 credit

Q32: The process of using accounts receivable as

Q86: The accounts receivable turnover is calculated by

Q138: A _ is a signed promise to

Q149: Crystal Products allows customers to use bank

Q192: As long as a company accurately records