Multiple Choice

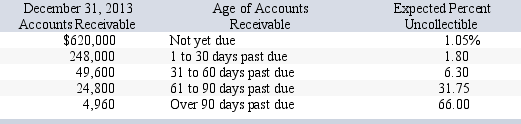

Temper Company has credit sales of $3.10 million for year 2013.Accounts Receivable total $947,360 and the company estimates that 2% of accounts receivable will remain uncollectible.Historically,.9% of sales have been uncollectible.On December 31,2013,the company's Allowance for Doubtful Accounts has an unadjusted debit balance of $2,575.Temper prepared a schedule of its December 31,2013,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:  Assuming the company uses the percent of accounts receivable method,what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

Assuming the company uses the percent of accounts receivable method,what is the amount that Temper will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

A) $18,947.20

B) $16,372.20

C) $23,024.40

D) $27,900.00

E) $21,522.20

Correct Answer:

Verified

Correct Answer:

Verified

Q29: If a 60-day note receivable is dated

Q55: The matching principle requires that accrued interest

Q90: When the maker of a note is

Q107: Credit sales are recorded by crediting an

Q108: If a customer owes interest on accounts

Q109: A company ages its accounts receivables to

Q113: Explain the basic differences between estimating the

Q114: A Company sold $10,000 of its accounts

Q117: When using the allowance method of accounting

Q117: Tecom accepts the NOVA credit card for