Multiple Choice

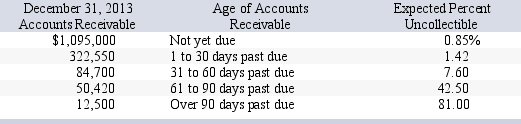

Chiller Company has credit sales of $5.60 million for year 2013.Chiller estimates that 1.32% of the credit sales will not be collected.Historically,4% of outstanding accounts receivable is uncollectible.On December 31,2013,the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $3,561.Chiller prepares a schedule of its December 31,2013,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:  Assuming the company uses the percent of sales method,

Assuming the company uses the percent of sales method,

-What is the amount that Chiller will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

A) $55,439.41

B) $73,920.00

C) $48,317.41

D) $70,359.00

E) $66,167.80

Correct Answer:

Verified

Correct Answer:

Verified

Q21: _ are amounts owed by customers from

Q45: The accounts receivable turnover is calculated by

Q92: The accounting principle that requires financial statements

Q135: Dell reported net sales of $8,739 million

Q136: Explain the options a company has when

Q138: A method of estimating bad debts expense

Q139: Frontline Company holds a $1,000,12%,90-day note of

Q141: The maturity date of a note refers

Q142: Welles Company uses the direct write-off method

Q151: TechCom's customer, RDA, paid off an $8,300