Essay

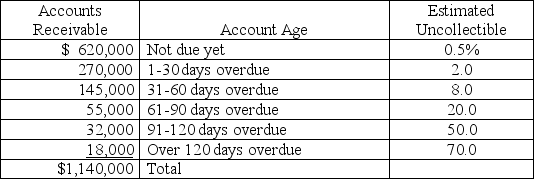

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year,an aging analysis of accounts receivable revealed the following:

Required:

Required:

a.Calculate the amount of the allowance for doubtful accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the bad debts expense that should be reported on the current year's income statement,assuming that the balance of the allowance for doubtful accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c.Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year.

d.Show how accounts receivable will appear on the current year-end balance sheet as of December 31.

Correct Answer:

Verified

a.  _TB6947_00_TB6947_00_TB6947...

_TB6947_00_TB6947_00_TB6947...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: _ is the charge for using (not

Q77: Wallah Company agreed to accept $5,000 in

Q78: A company factored $35,000 of its accounts

Q79: What is the maturity date of a

Q80: Mix Recording Studios purchased $7,800 in electronic

Q81: Match each of the following terms with

Q84: Temper Company has credit sales of $3.10

Q85: The formula for computing interest on a

Q87: According to GAAP,the amount of bad debt

Q155: When using the allowance method of accounting