Essay

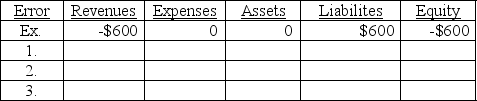

Given the table below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements and a "0" for no effect. The first one is done as an example.

Ex. Failed to recognize that $600 of unearned revenues, which were previously recorded as liabilities, had been earned by year-end.

1. Failed to accrue salaries expense of $1,200.

2. Forgot to record $2,700 of depreciation on office equipment.

3. Failed to accrue $300 of interest on a note receivable.

Correct Answer:

Verified

_TB6947_00...

_TB6947_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Which of the following is the usual

Q62: Prepaid expenses, depreciation, accrued expenses, unearned revenues,

Q106: The broad principle that requires expenses to

Q107: July 31,2013,the end of the quarter,is on

Q110: Deana DiAngelo opened a business called Deana's

Q113: Each letter below contains three of the

Q114: The following information is available for the

Q115: IFRS tends to be more principles-based compared

Q116: Interim financial statements refer to financial reports:<br>A)That

Q137: How is a classified balance sheet different