Multiple Choice

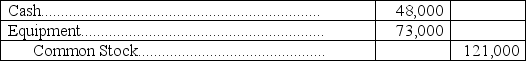

S.Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership.The journal entry to record the transaction for the partnership is:

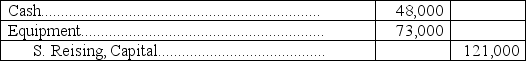

A)

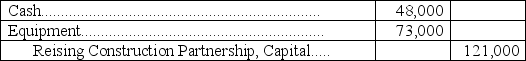

B)

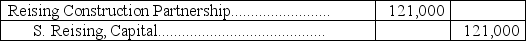

C)

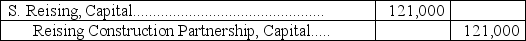

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Holden,Phillips,and Rogers are partners with beginning-year capital

Q19: Alberts and Bartel are partners.On October 1,Alberts'

Q21: Groh and Jackson are partners.Groh's capital balance

Q23: Partnership net income of $150,000 is to

Q24: The capital balances of Able,Bligh,and Coulter,who share

Q25: During 2013,Carpenter invested $75,000 and DiAngelo invested

Q26: Beard,Tanner,Williams are operating as a partnership.The capital

Q73: Web Services is organized as a limited

Q163: Limited liability partnerships are designed to protect

Q170: Discuss the options for the allocation of