Multiple Choice

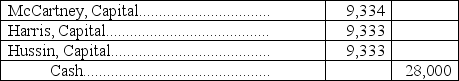

McCartney,Harris,and Hussin are dissolving their partnership.Their partnership agreement allocates income and losses equally among the partners.The current period's ending capital account balances are McCartney,$15,000,Harris,$15,000,Hussin,$(2,000) .After all the assets are sold and liabilities are paid,but before any contributions to cover any deficiencies,there is $28,000 in cash to be distributed.Hussin pays $2,000 to cover the deficiency in his account.The general journal entry to record the final distribution would be:

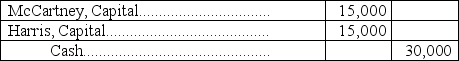

A)

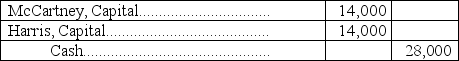

B)

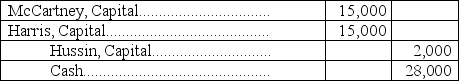

C)

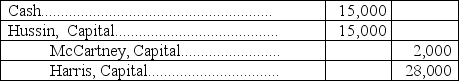

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The BlueFin Partnership agrees to dissolve. The

Q13: Conley and Liu allow Lepley to purchase

Q84: When a partner leaves a partnership, the

Q98: During 2013,Schmidt invested $75,000 and Baldwin invested

Q99: Active Sports LP is organized as a

Q104: Khalid,Dina,and James are partners with beginning-year capital

Q105: Armstrong plans to leave the FAP Partnership.The

Q107: S.Reising contributed $48,000 in cash plus equipment

Q129: When a partner invests in a partnership,

Q131: In the absence of a partnership agreement,