Multiple Choice

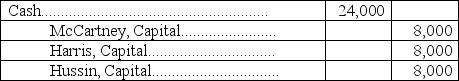

McCartney,Harris,and Hussin are dissolving their partnership.Their partnership agreement allocates each partner 1/3 of all income and losses.The current period's ending capital account balances are McCartney,$13,000; Harris,$13,000; and Hussin,$(2,000) .After all assets are sold and liabilities are paid,there is $24,000 in cash to be distributed.Hussin is unable to pay the deficiency.The journal entry to record the distribution should be:

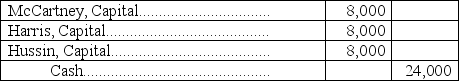

A)

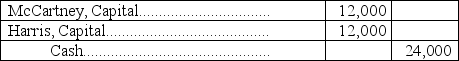

B)

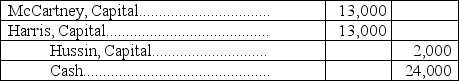

C)

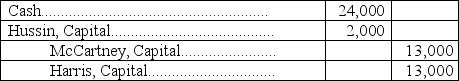

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Juanita invested $100,000 and Jacque invested $95,000

Q60: When the current value of a partnership

Q64: What are the ways that a new

Q81: A partnership cannot use salary allowances or

Q83: The partnership shows the following capital balances

Q85: Paco and Kate invested $99,000 and $126,000,respectively,in

Q86: A partnership that has at least two

Q92: _ means that partners can commit or

Q111: The life of a partnership is _

Q171: If a partner withdraws from a partnership