Multiple Choice

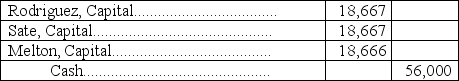

Rodriguez,Sate,and Melton are dissolving their partnership.Their partnership agreement allocates income and losses equally among the partners.The current period's ending capital account balances are Rodriguez,$30,000; Sate,$30,000; and Melton,$(4,000) .After all the assets are sold and liabilities are paid,but before any contributions are considered to cover any deficiencies,there is $56,000 in cash to be distributed.Melton pays $4,000 to cover the deficiency in her account.The general journal entry to record the final distribution would be:

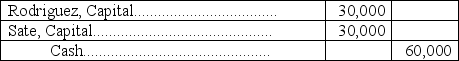

A)

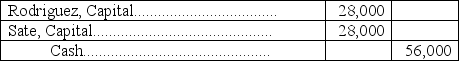

B)

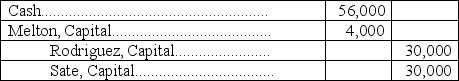

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A capital deficiency means that:<br>A) The partnership

Q10: Force and Zabala are partners.Force's capital balance

Q11: Shelby and Mortonson formed a partnership with

Q18: Holden,Phillips,and Rogers are partners with beginning-year capital

Q19: Alberts and Bartel are partners.On October 1,Alberts'

Q29: If the partners agree on a formula

Q37: Collins and Farina are forming a partnership.

Q108: The withdrawals account of each partner is

Q109: During the closing process, partner's capital accounts

Q170: Discuss the options for the allocation of