Essay

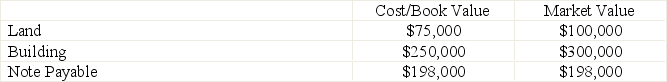

Kathleen Reilly and Ann Wolf decide to form a partnership on August 1.Reilly invested the following assets and liabilities in the new partnership:

The note payable is associated with the building and the partnership will assume the responsibility for the loan.Wolf invested $60,000 in cash and $105,000 in new equipment in the new partnership.Prepare the journal entries to record the two partner's original investments in the new partnership.

The note payable is associated with the building and the partnership will assume the responsibility for the loan.Wolf invested $60,000 in cash and $105,000 in new equipment in the new partnership.Prepare the journal entries to record the two partner's original investments in the new partnership.

Correct Answer:

Verified

_TB6947_00...

_TB6947_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Partnership net income of $150,000 is to

Q24: The capital balances of Able,Bligh,and Coulter,who share

Q25: During 2013,Carpenter invested $75,000 and DiAngelo invested

Q26: Beard,Tanner,Williams are operating as a partnership.The capital

Q29: A partnership that has two classes of

Q31: To buy into an existing partnership,the new

Q32: When a partner is unable to pay

Q94: A partnership has an unlimited life.

Q133: Explain the steps involved in the liquidation

Q163: Limited liability partnerships are designed to protect