Multiple Choice

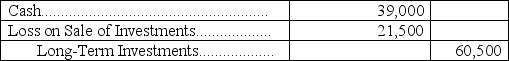

On January 4,2011,Larsen Company purchased 5,000 shares of Warner Company for $59,500 plus a broker's fee of $1,000.Warner Company has a total of 25,000 shares of common stock outstanding and it is presumed the Larsen Company will have a significant influence over Warner.During each of the next two years,Warner declared and paid cash dividends of $0.85 per share.Its net income was $72,000 and $67,000 for 2011 and 2012,respectively.The January 12,2013,entry to record the sale of 3,000 shares of Warner Company stock for $39,000 cash should be:

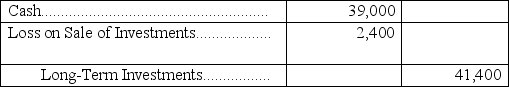

A)

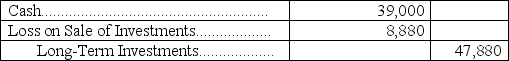

B)

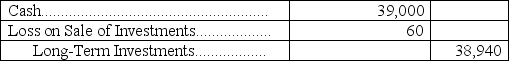

C)

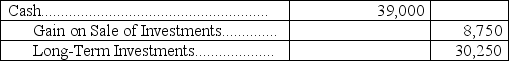

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Investments in trading securities are always short-term

Q7: The price of one currency stated in

Q8: An investor purchased $50,000 of bonds that

Q9: Short-term investments in held-to-maturity debt securities are

Q12: Identify the three types of classifications for

Q13: On January 2,2014,McLachlan Corp.paid $50,000 cash to

Q15: _ are investments that are both readily

Q50: When an equity security is sold,the sale

Q99: The price of one currency stated in

Q154: Explain how to record the sale of