Multiple Choice

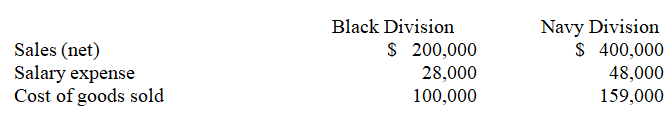

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

-Compute gross profit for the Black and Navy Divisions,respectively.

A) $72,000; $193,000.

B) $172,000; $352,000.

C) $100,000; $241,000.

D) $52,000; $163,000.

E) $72,000; $163,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: The concepts of direct expenses and uncontrollable

Q70: A department's direct expenses are usually considered

Q131: An example of a controllable cost is

Q137: Differential Chemical produced 10,000 gallons of Preon

Q172: In a decentralized organization, decisions are made

Q179: The following is a partially completed lower

Q181: Using the information below,compute the cash conversion

Q183: The investment center return on investment is

Q185: Two investment centers at Marshman Corporation have

Q187: Marks Corporation has two operating departments,Drilling and