Multiple Choice

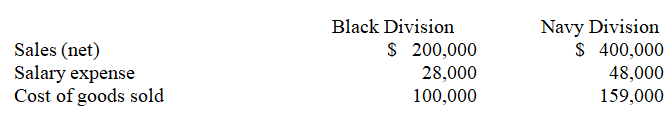

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

-Compute departmental income for the Black and Navy Divisions,respectively.

A) $52,000; $163,000.

B) $172,000; $352,000.

C) $72,000; $163,000.

D) $72,000; $193,000.

E) $100,000; $241,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Investment center managers are usually evaluated using

Q37: Pleasant Hills Properties is developing a golf

Q42: The following is a partially completed lower

Q43: A company rents a building with a

Q44: Marks Corporation has two operating departments,Drilling and

Q46: A retail store has three departments,S,T,and U,and

Q115: Division P of Launch Corporation has the

Q125: The amount by which a department's sales

Q161: A system of performance measures, including nonfinancial

Q187: A cost center does not directly generate