Multiple Choice

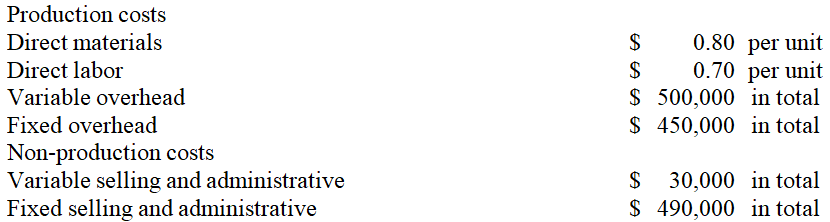

Vision Tester,Inc.,a manufacturer of optical glass,began operations on February 1 of the current year.During this time,the company produced 900,000 units and sold 800,000 units at a sales price of $12 per unit.Cost information for this year is shown in the following table:  Given this information,which of the following is true?

Given this information,which of the following is true?

A) Net income under variable costing will exceed net income under absorption costing by $50,000.

B) Net income under absorption costing will exceed net income under variable costing by $50,000.

C) Net income will be the same under both absorption and variable costing.

D) Net income under variable costing will exceed net income under absorption costing by $60,000.

E) Net income under absorption costing will exceed net income under variable costing by $60,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Mentor Corp.has provided the following information for

Q68: The variable costing income statement classifies costs

Q69: Kluber,Inc.had net income of $900,000 based on

Q70: Sales less total variable costs equals manufacturing

Q71: During its first year of operations,the McCormick

Q73: Quaker Corporation sold 6,600 units of its

Q74: The biggest problems with producing too much

Q75: State Industries has the following information for

Q76: Given the Cool Pools Company data,what is

Q77: A company is currently operating at 75%