Multiple Choice

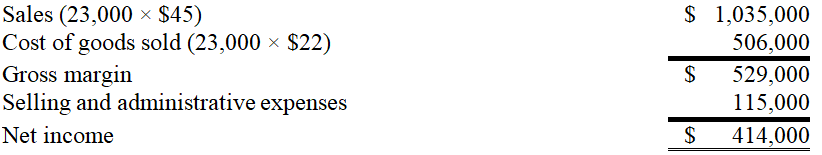

Fields Cutlery,a manufacturer of gourmet knife sets,produced 20,000 sets and sold 23,000 units during the current year.Beginning inventory under absorption costing consisted of 3,000 units valued at $66,000 (Direct materials $12 per unit; Direct labor,$3 per unit; Variable Overhead,$2 per unit,and Fixed overhead,$5 per unit.) All manufacturing costs have remained constant over the 2-year period.At year-end,the company reported the following income statement using absorption costing:  60% of total selling and administrative expenses are variable.Compute net income under variable costing.

60% of total selling and administrative expenses are variable.Compute net income under variable costing.

A) $414,000

B) $399,000

C) $529,000

D) $429,000

E) $644,000

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Heather,Incorporated reports the following annual cost data

Q49: To convert variable costing income to absorption

Q50: Digby Company manufactured and sold 37,000 units

Q51: What costs are treated as product costs

Q52: Given Advanced Company's data,compute cost per unit

Q54: Hayes Inc.provided the following information for the

Q55: Under absorption costing,the product unit cost consists

Q56: Match the following.

Q57: A company is currently operating at 65%

Q58: For short-term pricing decisions,absorption costing is an