Multiple Choice

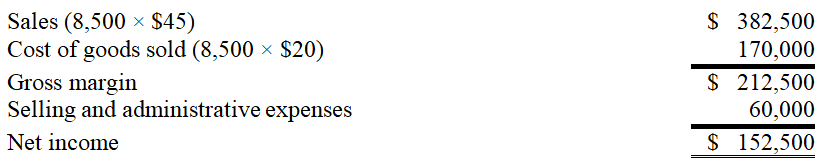

Wind Fall,a manufacturer of leaf blowers,began operations this year.During this year,the company produced 10,000 leaf blowers and sold 8,500.At year-end,the company reported the following income statement using absorption costing:  Production costs per leaf blower total $20,which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) .Fifteen percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per leaf blower total $20,which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) .Fifteen percent of total selling and administrative expenses are variable.Compute net income under variable costing.

A) $146,500

B) $158,500

C) $237,500

D) $206,500

E) $246,500

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Given the Scavenger Company data,what is net

Q16: A per unit cost that is constant

Q17: What are the limitations of using variable

Q18: Given the following data,total product cost per

Q19: Assuming fixed costs remain constant,and a company

Q21: Under absorption costing,a company had the following

Q22: Maloney Co.provided the following information for the

Q23: Assuming fixed costs remain constant,and a company

Q24: Fixed costs change in the short run

Q25: Lukin Corporation reports the following first year