Multiple Choice

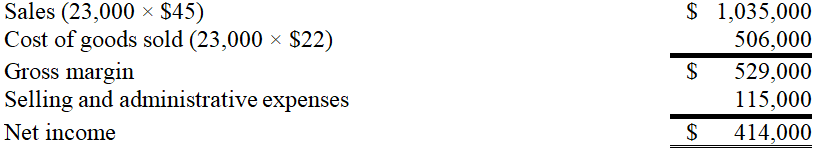

Aces,Inc.,a manufacturer of tennis rackets,began operations this year.The company produced 6,000 rackets and sold 4,900.At year-end,the company reported the following income statement using absorption costing.  Production costs per tennis racket total $38,which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) .Ten percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per tennis racket total $38,which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) .Ten percent of total selling and administrative expenses are variable.Compute net income under variable costing.

A) $194,100

B) $165,500

C) $311,000

D) $240,500

E) $233,000

Correct Answer:

Verified

Correct Answer:

Verified

Q86: A company normally sells a product for

Q87: Assume a company sells a given product

Q88: When the number of units sold exceed

Q89: _ costing is the only acceptable basis

Q90: When excess capacity exists,managers should accept a

Q92: Materials Corporation sold 12,000 units of its

Q93: What is the general procedure for converting

Q94: Given the following data,total product cost per

Q95: A company normally sells a product for

Q96: Given Advanced Company's data,compute cost of finished