Essay

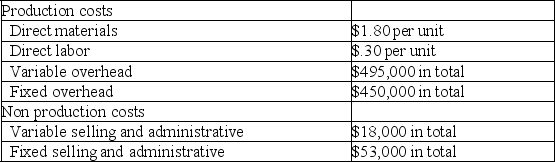

Stonehenge Inc.,a manufacturer of landscaping blocks,began operations on April 1 of the current year.During this time,the company produced 750,000 units and sold 720,000 units at a sales price of $9 per unit.Cost information for this period is shown in the following table:

a.Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

a.Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

b.Prepare Stonehenge's December 31st income statement for the current year under variable costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q162: Given the following data,total product cost per

Q163: Contribution margin is also known as gross

Q164: _ is the amount remaining from sales

Q165: Toth,Inc.had net income of $950,000 based on

Q166: Variable costing treats fixed overhead cost as

Q168: _ is the amount remaining from sales

Q169: Which of the following costing methods charges

Q170: Wrap-It Company,a manufacturer of wrapping paper,began operations

Q171: When setting long-term sales prices for products,the

Q172: Reported income is identical under absorption costing