Essay

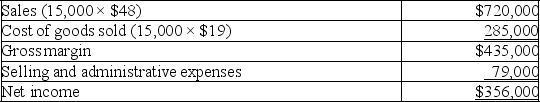

Anchovy,Inc.,a producer of frozen pizzas,began operations this year.During this year,the company produced 16,000 cases of pizza and sold 15,000.At year-end,the company reported the following income statement using absorption costing:

Production costs per case total $19,which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced).Eight percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per case total $19,which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced).Eight percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Correct Answer:

Verified

Income under absorption costing = Income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: State Industries has the following information for

Q76: Given the Cool Pools Company data,what is

Q77: A company is currently operating at 75%

Q78: The absorption costing approach assigns all manufacturing

Q79: If a company has excess capacity,increases in

Q81: Mentor Corp.has provided the following information for

Q82: Under variable costing,product costs consist of direct

Q83: Which of the following best describes costs

Q84: When units produced exceed the units sold,income

Q85: Given the following data,total product cost per