Essay

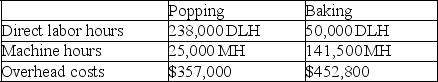

Blast Rocket Company manufactures candy-coated popcorn treats that go through two operations,popping and baking,before they are complete.Expected costs and activities for the two departments are shown in the following table:

a.Compute a departmental overhead rate for the popping department based on direct labor hours.

a.Compute a departmental overhead rate for the popping department based on direct labor hours.

b.Compute a departmental overhead rate for the baking department based on machine hours.

Correct Answer:

Verified

a.$357,000/238,000 D...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q186: Identify each of the following activities as

Q187: Assume New Belgium Brewing Company manufactures and

Q188: A major disadvantage of using a plantwide

Q189: A company produces paint that goes through

Q190: Compute Tasty's departmental overhead rate for the

Q192: All of the following are examples of

Q193: Bark Mode,Incorporated produces and distributes two types

Q194: When using the plantwide overhead rate method,total

Q195: Which of the following companies would be

Q196: Outer Limits,Inc.produces fencing units which require two